Health insurance payroll deduction calculator

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 2022 Federal income tax withholding calculation.

Payroll Tax Calculator For Employers Gusto

Contributions to health vision and dental insurance plans.

. For example if an employee earns 1500. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Generally health insurance plans that an employer deducts from an employees gross pay are pre-tax plans. The annual cost is divided by the number of. Typically this is your gross earnings.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. All Services Backed by Tax Guarantee. 2022 Federal income tax withholding calculation.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Subtract 12900 for Married otherwise. While shopping for health benefits.

You can enter your current payroll information and deductions and then compare them to your. Small Business Health Insurance Is Complicated eHealth Is Here to Help. Employee premiums generally depend on the amount the employer contributes the provider rates and the type of plan the employee selects.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Payroll withholdings for health insurance are the amounts deducted from employees pay for their portion of the cost for the companys health insurance plan. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

How to calculate annual income. You can enter your current payroll information and deductions and. Use this calculator to help you determine the impact of changing your payroll deductions.

Ad Search 2022 Health Insurance Plans by ZIP. Determine the employees medical premium. Ad Explore Plans From 1300 Small Business Health Insurance Plans From 70 Carriers.

Compare your plan options online or over the phone. For example if you earn 2000week your annual income is calculated by. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Subtract 12900 for Married otherwise. During the tax year the employer works out the taxable amount of the benefit and adds this to the employees actual monthly pay. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Health Insurance POP etc. Assume that the cost of a companys health insurance plan is 300 per biweekly pay period and that the employee is responsible for paying 25 of the cost through payroll withholding. All Services Backed by Tax Guarantee.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. But thats not always the case.

The maximum an employee will pay in 2022 is 911400. Ad Get personalized health insurance quotes with affordable costs in minutes. An employees contribution to certain health plans may qualify as pretax deductions.

It can also be used to help fill steps 3 and 4 of a W-4 form.

How To Calculate Net Pay Step By Step Example

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

What Are Marriage Penalties And Bonuses Tax Policy Center

Are Payroll Deductions For Health Insurance Pre Tax Details More

How To Calculate Federal Income Tax

Solved W2 Box 1 Not Calculating Correctly

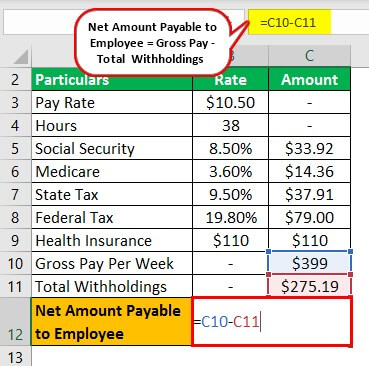

Payroll Formula Step By Step Calculation With Examples

Payroll Formula Step By Step Calculation With Examples

Payroll Formula Step By Step Calculation With Examples

Payroll Tax What It Is How To Calculate It Bench Accounting

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Calculator Take Home Pay Calculator

:max_bytes(150000):strip_icc()/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

What Are Payroll Deductions Article

What Are Payroll Deductions Article

![]()

Household Health Spending Calculator Peterson Kff Health System Tracker

How To Do Payroll In Excel In 7 Steps Free Template